Are you travelling abroad on holiday or on a business trip? We are offering you tips and advice on how to safely withdraw money from an ATM, pay at a merchant and reserve a car without any problems.

1. Withdrawals from ATMs:

- If the ATM offers settlement of a withdrawal in the currency of your card, always choose settlement in the local currency, i.e. when withdrawing cash abroad, always choose the option of withdrawal without conversion.

- If the operator of the ATM network abroad charges a fee for cash withdrawals, it should inform you of such fee and its amount before confirming the transaction.

- When you are abroad, preferably make withdrawals from UniCredit Bank ATMs or ATMs with the logo of a foreign bank. ATMs without a bank logo usually have a less favourable exchange rate.

- If a problem occurs when withdrawing cash from a foreign ATM and the card and its limits are in order, this may involve a restriction set by the operator of the foreign ATM. In this case, you should look for an ATM of another bank.

TIP: : If the chosen ATM does not accept your card, look for an ATM in a different banking network.

2. Payments at merchants:

- If the merchant’s terminal offers settlement of the transaction in the currency of your card or in the local currency, always choose settlement in the local currency in order to avoid an unfavourable conversion rate.

- When paying, always hold on to your card and execute payments by placing the card near the reader or inserting it into the terminal.

TIP: Before you go on holiday, check your card limits (limit for payments at merchants and ATM withdrawal limit). You can change your limits in your Smart Banking (free of charge), on the Infoline at +420 221 210 031 or at one of our branches (for a fee).

3. Frequent travel abroad / long-term stay abroad:

- Before travelling abroad, we recommend that you open a foreign currency account in the currency of the country to which you are travelling (we can connect your debit card to up to 16 accounts). It is important to have sufficient funds in the account.

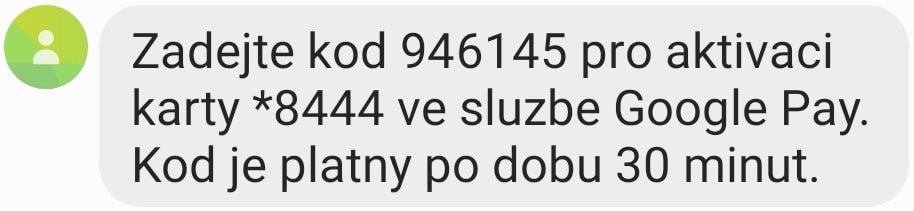

4. Add your card to the Google Pay or Apple Pay service:

- Find out whether these services are supported in the given country

- You can find all information about Google payments HERE

- You can find all information about Apple payments HERE

5. PIN code blocking:

- If your PIN code is entered incorrectly three consecutive times, it will be blocked. In such a case, contact the Infoline as soon as possible. An operator will advise you on how to correctly unblock your PIN.

6. Changing your PIN code via an ATM abroad:

- We do not recommend changing your PIN code via an ATM abroad

- Most ATMs abroad do not support this service

- Most domestic ATMs do not support changing the PIN code of a customer of a different bank

TIP: If you have forgotten your PIN or you want to verify it, we recommend using the PIN display service in Smart Banking, which is free of charge

7. Card blocking:

- For short-term blocking, you can use the service in Smart Banking, which will enable you to temporarily block your payment card without a fee

- If your card is lost/stolen, we recommend that you permanently block it as soon as possible via the Infoline at +420 221 210 031

8. Card seizure at an ATM abroad:

- Contact the UniCredit Bank Infoline and request blocking and reissuance of the card

TIP: When travelling abroad, we recommend that you have at least two cards with you.

9. Travel insurance with your card:

- Our bank offers the option of short-term and long-term travel insurance with your payment card. Take advantage of these offers, which relate not only to you, but also to your family members (spouse, children).

- You can find all essential information about travel insurance HERE

- An airport lounge is available to VISA Premium cardholders in Prague

- All benefits are described HERE

10. Using your card to reserve a car:

- Before travelling abroad, verify the possibility of reserving a car and the acceptance of individual types of cards at the particular car-rental agency

- The merchant has the right to refuse acceptance of the types of card’s that are not supported by the merchant’s terminal

- If the terms and conditions for reserving a car are not fulfilled, the bank shall not be responsible for the non-acceptance of a card

If you have not found the answers to your questions here, please contact our Infoline or visit one of our branches.